Latest News

2022 Start working on a new website

BBS Trading Expert

Watch the Youtube BBS video and here is a crude oil trading example

Want to know more about:

AXIOM business books awards, bronze medal! Thank You!

No longer available!

Favorite articles in 2010, 11, 12, 14 and 2015 S&C Readers' Choice Awards.

AXIOM Business Books Awards, bronze medal.

Technical Analysis Elliott Waves Part 4

Correction Patterns

- Recognizing correction waves is more difficult than recognizing impulse waves.

- There are more correction patterns than impulse patterns.

- Correction patterns have the tendency to develop more complex combinations.

- The most important rule is that a correction wave of the same order can never have 5 waves.

- Only impulse waves have 5 waves.

- A correction consisting of a 5 impulse wave can therefore never be the end of that correction.

Zigzag

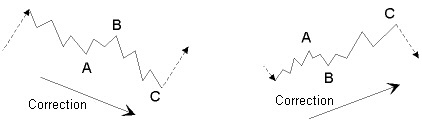

The zigzag pattern shown in figure 7.21 is the most common correction structure.

Special offer: "Capturing Profit with technical Analysis"

Figure 7.21: The zigzag pattern is the most common correction structure.

A zigzag can consist of one zigzag, a double zigzag, or, rarely, a triple zigzag. The zigzag belongs to the family of sharp corrections.

Rules and Guidelines

- A zigzag correction has three waves.

- Wave A is an impulse wave or a starting wedge impulse wave.

- Wave B can be any kind of correction pattern.

- Wave B is smaller than wave A.

- Wave C is an impulse wave or an ending wedge impulse wave.

- Wave C is not an ending wedge impulse wave if wave A is a starting wedge impulse wave.

A simple zigzag pattern has three waves. A double zigzag pattern has seven waves, two simple zigzags separated by an X wave. A triple zigzag has 11 waves with two X waves.

The structure of the three waves in a simple zigzag is 5-3-5 and 5-3-5-3-5-3-5 in a double zigzag.

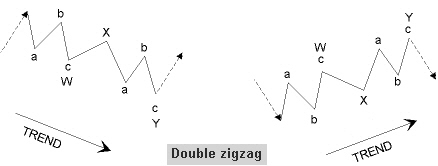

Double and Triple Zigzag Patterns

We use WXY to denote a double zigzag, instead of the standard ABCXABC Elliott notation. For the triple zigzag, this becomes WXYX²Z.

Figure 7.22: Double zigzag pattern using WXY notation.

As you can see in figure 7.22, this is a more consistent way of notation because more zigzags of a lower order (ABC) are connected together by a higher order wave (XYZ).

Rules and Guidelines

- Wave W must be a zigzag pattern.

- Wave X can be any correction pattern, except an inverted broadening triangle.

- Wave X is smaller than wave W.

- Wave Y must be a zigzag pattern.

- Wave Y is, at minimum, equal or bigger than wave X.

- Wave X² can be any correction pattern, except an inverted broadening triangle.

- Wave X² is smaller than wave Y.

- Wave Z must be a zigzag pattern.

- Wave Z is, at minimum, equal or bigger than wave X².

Elliott Waves Next -Previous -Part 1 -Part 2 -Part 3 -Part 4 -Part 5 -Part 6 -Part 7

STOCATA Stocks Technical Analysis HOME

Links

Find a Stock ticker symbol, enter the ticker and find a chart, news, fundamentals and historical quotes.

Risk Disclosure: Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Hypothetical Performance Disclosure: Hypothetical performance results have many inherent limitations, some of which are described below. no representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. for example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.

See more 'Legal Disclosures' in the bottom menu bar!