Latest News

2022 Start working on a new website

BBS Trading Expert

Watch the Youtube BBS video and here is a crude oil trading example

Want to know more about:

AXIOM business books awards, bronze medal! Thank You!

No longer available!

Favorite articles in 2010, 11, 12, 14 and 2015 S&C Readers' Choice Awards.

AXIOM Business Books Awards, bronze medal.

Investing your Savings PART2

GOTO: part1 - part3 - part4 - part5 - Special Techniques - HOME

With this presentation I want you to start thinking about investing your savings in the stock market. Not waiting until you have more free time, more savings or just waiting until your retirement. Because your best chance for success is that you are still young and therefore able to profit from a compounding investment strategy for the years to come. Compare the different possibilities.

Long Term Trading

Keeping all the trading techniques in mind presented in part1, first let’s assume you have very, very little time for trading. Just about an hour at the end of the month.

For an automatic calculation of the historical trading results, I will use my auto trading expert system SATS5.

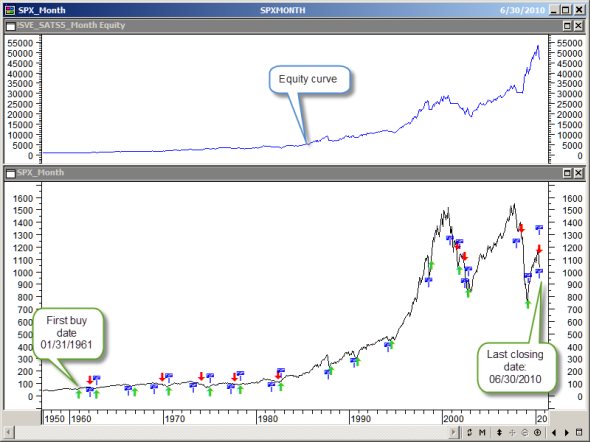

Let’s assume a starting capital of $1,000 in 1961. Using the method of SATS5 on monthly bars and trading only the S&P500 index, what is the result?

Trading long and short on a monthly basis, the first buy was on January 31, 1961 and the last closing date used was June 30, 2010. There were a total of 23 trades, an average of just 1 trade every 2 years. Eighteen trades made a profit and 5 were losing trades.

The total profit was $45,396. This represents an average compounded interest rate of 8% per year totaling 45 times your initial capital. That is not bad for an hours’ work once every month.

Using a Margin Account

If you are prepared making (partly) use of a margin account, you can make a lot more profit.

The margin level you can use is very dependent of the maximum drawback of your system which in turn is closely related to the trading time period.

Be very careful, you will kill your entire account making use of a too high margin level.

Trading on monthly signals my advice is to start limiting the margin to an extra 25% and if you are very confident go to 50%, with an absolute maximum of 100%. In other words start with 1.25 and use 1.5 to maximum 2 times the real available funds.

The result with a 1.25 to 1 ratio with the same technical signals as before is $130,600 or almost 3 times the profit compared to not using any margin. That is a compounded interest rate of 10.3% per year or your starting capital times 130.

The result with a 1.5 to 1 ratio with the same signals is $213,500, almost 5 times as much compared to not using any margin. Or a compounded interest rate of 11.3% per year multiplying your starting capital by 213.

The result with a 2 to 1 ratio with the same signals is $450,000 or 10 times as much not using any margin. This amount gives you a compounded interest rate of 13% per year or 450 times the starting capital.

Note how small differences in interest rate create big differences in the final dollar amount thanks to the compounding effect using a long term period.

It looks like the compounding trading strategy together with using a margin account and being young enough makes the ideal combination to grow a small amount of money to a big amount by the time you are retiring.

Not Starting the Ideal Moment in Time

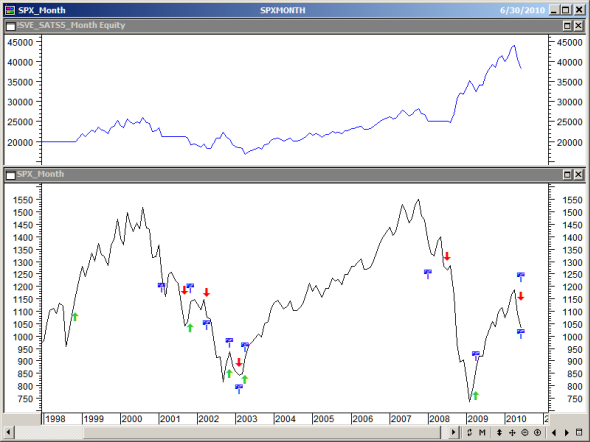

Let’s have a look if we would have started trading only in 1999, close to the first top.

By June 2010 we would still have made a 90% profit, where a buy and hold would result in a loss.

What if you are already at an age that you do not have too much time left? But on the other hand you can and you are prepared to spend some time every day.

Continue reading part3.

GOTO: part1 - part3 - part4 - part5 - Special Techniques - HOME

Links

Find a Stock ticker symbol, enter the ticker and find a chart, news, fundamentals and historical quotes.

Risk Disclosure: Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Hypothetical Performance Disclosure: Hypothetical performance results have many inherent limitations, some of which are described below. no representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. for example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.

See more 'Legal Disclosures' in the bottom menu bar!