Latest News

2022 Start working on a new website

BBS Trading Expert

Watch the Youtube BBS video and here is a crude oil trading example

Want to know more about:

AXIOM business books awards, bronze medal! Thank You!

No longer available!

Favorite articles in 2010, 11, 12, 14 and 2015 S&C Readers' Choice Awards.

AXIOM Business Books Awards, bronze medal.

Investing your Savings PART5

GOTO: part1 - part2 - part3 - part4 - Special Techniques - HOME

With this presentation I want you to start thinking about investing your savings in the stock market. Not waiting until you have more free time, more savings or just waiting until your retirement. Because your best chance for success is that you are still young and therefore able to profit from a compounding investment strategy for the years to come. Compare the different possibilities.

Day Trading

Maybe you do not have that much time anymore, probably already coming close to your retirement? In that case starting to learn day trading may be something for you.

Looking for the most liquid markets you can trade the futures and FOREX markets. I consider the most liquid and most interesting ones the S&P500 (ES) E-Mini future and the EUR/USD FOREX pair.

Trading the S&P500 E-Mini Future

The E-Mini future moves in 0.25 point increments. One future contract represents $12.5 for a move of 0.25 Index points. At an index level of 1200 this represents a trading capital of $60,000. However, you only need a fraction of this amount (a margin) to trade this future. But never forget that trading 10 of these mini contracts represent a trading capital of $600,000. You can trade this future around the clock.

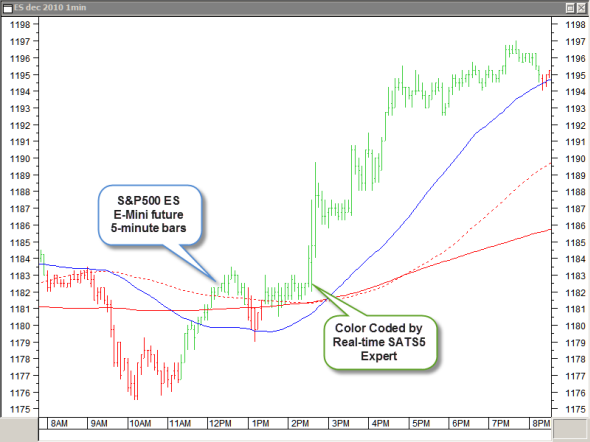

In the chart below you can see one of those nice trading days in a 5-minute bar chart. The bars are color coded by a real time SATS5 expert.

There is a first sell signal at 08:00 with an index of 1182.25. The next green bar at 11:20 we close this short position at 1177.75. A profit of $225 per contract.

We now open a long position at 1177.75 remaining open until the next red bar at 13:00. The value of $1180.5 gives a profit of $137.5. And we open a new short position at 1180.5.

This short position is closed 13:25 at the next green bar and a value of $1180, a loss of $25. A new long position is opened at $1180.

This position is closed 20:20 at the next red bar at $1194.5. A profit of $725.

The total profit is $1062.5 per contract. With a basic capital of $50,000, you could trade up to 5 contracts on a 5 minute bar chart. In that case you would have made more than $5,000 in just one day.

Be careful, there is a lot to learn before you can start trading futures real-time.

Trading the FOREX with the EUR/USD currency pair

"Forex" stands for foreign exchange. In a forex trade, you buy one currency while simultaneously selling another - that is, you're exchanging the sold currency for the one you're buying. Currencies trade in pairs, like the Euro-US Dollar (EUR/USD). Unlike stocks or futures, there's no centralized exchange for forex. All transactions happen via phone or electronic network.

Daily turnover in the world's currencies comes from two sources:

Foreign trade (5%). Companies buy and sell products in foreign countries, plus convert profits from foreign sales into domestic currency.

Speculation for profit (95%).

FOREX is the world's most traded market, trading 24 hours a day, and with an average daily turnover of $4,000 billion, forex is the most traded market in the world.

A pip is the smallest price increment in forex trading – pip stands for percentage in point.

Most prices are quoted to the fourth decimal point. A EUR/USD price change from 1.1111 to 1.1119 is a move of 8 pips. Bid and ask prices are with the right broker only 1 pip apart. FOREX is traded on margin. Some brokers will allow a margin factor up to 500. With $10,000 you could trade up to $5,000,000. Depending of the broker you are trading either an amount or a pip multiplication factor.

Double your savings in days?

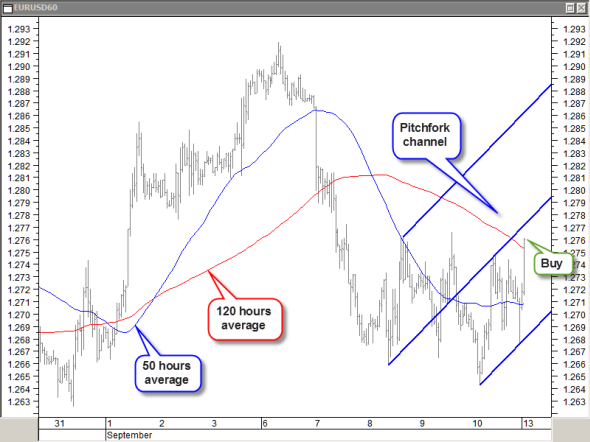

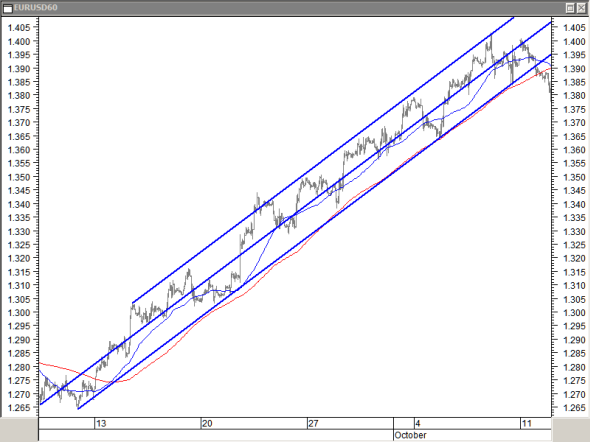

The following chart is an hourly bar chart of the EUR/USD FOREX pair.

Let’s assume an account with €10,000 and that we are trading 1 pip equals €10.

After the top of September 6, price makes lower highs and lower lows. From September 10 price is making higher lows, a first sign of a trend reversal. Price is moving above the 50 hours average and now breaking above the 120 hours average. Price is nicely moving within a 3-point pitchfork channel, moving up along the median line.

We open a long position here at 1.2760 with a stop at 1.2710, 50 pips below the buying price at the level of previous support and the active support of the 50 hours average.

September 15 price moves out of the upper channel, making a new top.

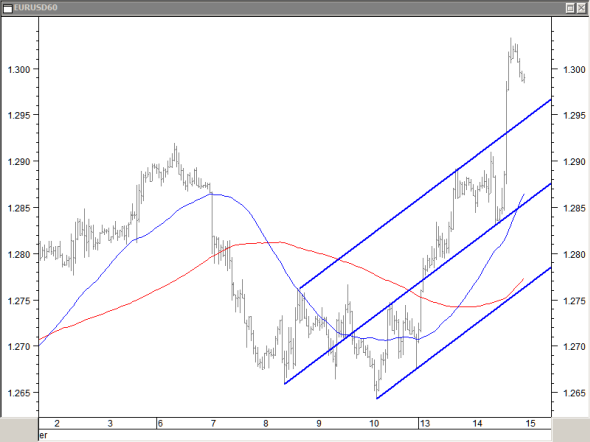

We are displacing the upper pitchfork reference to this point, looking for a sharper up move as suggested by the 50 hours average, also wider for a longer period up move and more in line with the up move until now.

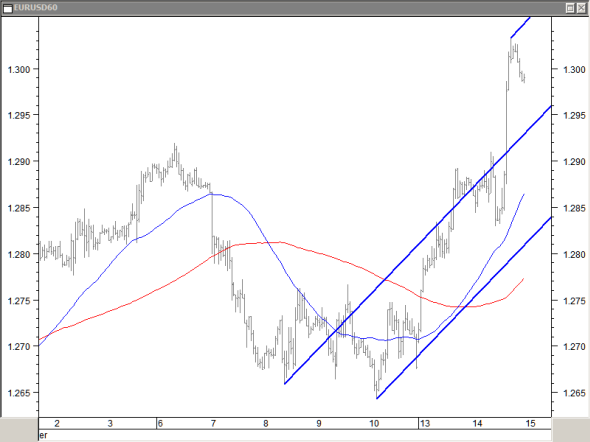

From that point on price continues the up move within the pitchfork channel and finding active support on 120 hours average. October 11 price breaks out of the channel and below the 120 hours average. The position is closed at 1.3873.

This gives a profit of 1113 pips or €11,130 doubling your money in less than a month.

WARNING! Do not try this unless you are very experienced and preferably only with money you can effort to lose in full!

I consider this article series a success I have convinced you to start seriously thinking doing something with your savings now!

GOTO: part1 - part2 - part3 - part4 - Special Techniques - HOME

Links

Find a Stock ticker symbol, enter the ticker and find a chart, news, fundamentals and historical quotes.

Risk Disclosure: Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Hypothetical Performance Disclosure: Hypothetical performance results have many inherent limitations, some of which are described below. no representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. for example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.

See more 'Legal Disclosures' in the bottom menu bar!