Latest News

2022 Start working on a new website

BBS Trading Expert

Watch the Youtube BBS video and here is a crude oil trading example

Want to know more about:

AXIOM business books awards, bronze medal! Thank You!

No longer available!

Favorite articles in 2010, 11, 12, 14 and 2015 S&C Readers' Choice Awards.

AXIOM Business Books Awards, bronze medal.

Investing your Savings PART4

GOTO: part1 - part2 - part3 - part5 - Special Techniques - HOME

With this presentation I want you to start thinking about investing your savings in the stock market. Not waiting until you have more free time, more savings or just waiting until your retirement. Because your best chance for success is that you are still young and therefore able to profit from a compounding investment strategy for the years to come. Compare the different possibilities.

Trading Call and Put options

-> Every option represents a contract between a buyer and a seller. The seller, called writer of the contract has an obligation to buy or sell the underlying, depending of the contract type (call or put). The buyer of the option contract has the right, but not the obligation, to buy or sell the underlying or to close the contract.

-> The strike price of an option is the price at which the writer of the option agrees to buy or sell the underlying.

-> The expiration month is the month the option will expire.

-> The expiration date is normally the third Friday of the month when the option is scheduled to expire.

-> An option contract represents normally 100 shares of the underlying.

-> A call option gives the option buyer the right, but not the obligation, to purchase 100 shares of the underlying at the strike price until expiration date. Practically all call option buyers will not purchase the underlying but will sell the call option with a profit or loss before the end of the contract.

-> A put option gives the option buyer the right, but not the obligation, to sell 100 shares of the underlying at the strike price until expiration date. Practically all put option buyers will not sell the underlying but will sell the put option at a profit or loss in the market.

The disadvantage of an option contract is that it expires!

-> But trading options instead of trading stocks has advantages. Let me explain! Limiting risk trading stocks on a daily chart by using stops need to be in the order of 10% to 15% related to the volatility of that stock. An alternative for buying the stock, willing to take a loss of 10% to 15%, is buying an option for 10% to 15% of the value when buying the stock. The advantage is that you can never lose more than what you pay buying the option contract. As mentioned before, the biggest disadvantage is that the option has an expiration date and the option price is highly influenced by the stock volatility.

-> Suppose you have a trading account of $100,000. You would take $15,000 to trade options. The remaining $85,000 can be put in a savings account or any very secure investment.

-> My advice is to buy long term option contracts or options with at least 6 month’s left to expiration. If feasible, buy an in-the-money option or slightly out-of-the-money. Limit the value of one option trade between $500 and maximum $1,000 with the $15,000 account.

-> Trading options this way is less stressful; you know on beforehand exactly how much you can lose while on the other hand making as much money as trading the stock. Let’s look at an example with US Steel.

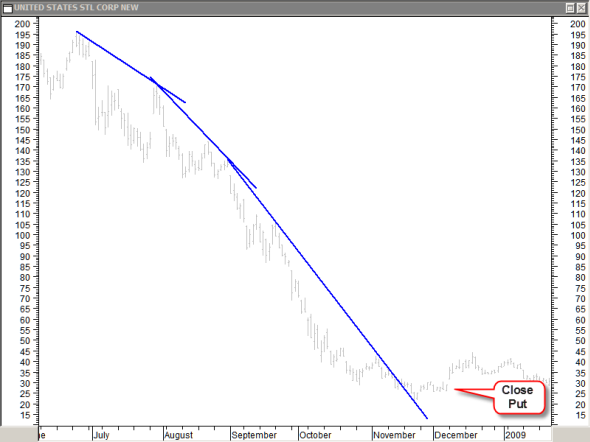

Looking at the chart until November 1, 2007, there was a price up move from $35 till $125. The stock has made a lower bottom and now makes a lower top. Price now breaks support and we expect price to fall at least below the last bottom. Let’s investigate the difference going short on the stock or buying a put option.

Case 1 - 11/01/2007 shorting the stock:

We open a position selling 100 pieces at $100, totaling $10,000 maintaining a stop 15% higher at $115. If that point is reached we will take the loss of $1,500 unless we can come up with very strong arguments to wait a few days. Our investment is $10,000 and we will try to limit the risk to $1,500.

Case 2 – 11/01/2007 buying a put option:

We buy a long term put option contract. A put January 2009 with an at-the-money strike price of $100 costs $15.8 or for 1 contract $1,580, close to 15% of the stock value. A put January 2009 with an out-of-the-money price of $90 costs $11.7 or for 1 contract $1,170. Since we are aiming for a bigger down move in the long run, we prefer the $90 strike price. If it turns out bad, there is less loss. We buy the put January 2009 with a strike price of $90 for a total of $1,170. Our investment and maximum risk is $1,170.

Case 1 – December 2007 closing the stock position:

After an initial profit price turns up by the end of November, breaking the stop near the end of December 2007. The position is closed at $115.5 or a loss of $1,550. Clearly that moment in time that was the best thing to do. Holding on to the short position would have created very big losses by June 2008 with the stock moving up to $195, close to a 100% loss.

Case 2 – December 2007 put option:

Of course the put option January 2009 with an exercise price of $90 is only worth a few cents by that time. But it is still a valid contract!

Case 2 – November 2008 very profitable put option:

From the high in June price drops to a low of $20. As you can see with the trend lines, the move down accelerated in tree steps. At the breaking of the third downtrend line there was ample opportunity to sell the put option at a stock price around $30. That makes a difference with the strike price of $60. The total profit is $6,000. With the option alternative trading the loss of $1,550 is turned into a profit of $6,000, while the risk was never more than $1,170.

Where did you read that trading options is very risky?

Simply buying options is less risky than trading stocks if you consider trading option contracts equivalent to the risk you are willing to take trading the stock.

WARNING: Unless you are very experienced, do not write option contracts or play other option strategies.

Continue reading part5.

GOTO: part1 - part2 - part3 - part5 - Special Techniques - HOME

Links

Find a Stock ticker symbol, enter the ticker and find a chart, news, fundamentals and historical quotes.

Risk Disclosure: Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Hypothetical Performance Disclosure: Hypothetical performance results have many inherent limitations, some of which are described below. no representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. for example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.

See more 'Legal Disclosures' in the bottom menu bar!